新闻动态 / NEWS

新闻动态 / NEWS

-

[ 2018-06-13 ]

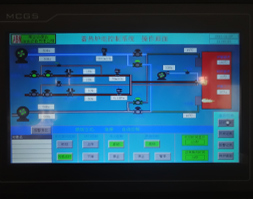

技术实力

研发平台

研发平台

公司建有河北省认定的企业技术中心,拥有30多名专业技术研发人员,组成高层次创新团队,不断超越自我,坚持“更安全、更环保、更节能”的创新理念...

-

+关于我们

-

+产品展示

-

+技术实力

-

+开云APP官网入口(中国)开云有限公司官网

中国·河北·保定·清苑区发展西路399号

中国·河北·保定·清苑区发展西路399号 0086-0312-5802355

0086-0312-5802355 0086-312-5802356

0086-312-5802356 071105

071105 友情链接

扫描二维码访问官方微信

Copyright © 2016 开云APP官网入口(中国)开云有限公司官网 All Rights Reserved 冀ICP备11000401-2

研发成果

研发成果